Thank you Emmett for asking:

Do you have a go-to-market strategy in mind for the 2 TCRs you’re proposing in this idea? So you’d have 1 registry for the reports and 1 registry for evaluations correct? How would this data be consumed and what would be the practical use of a DAO in this context? Also, what kind of utility would the token have?

Some really good questions here

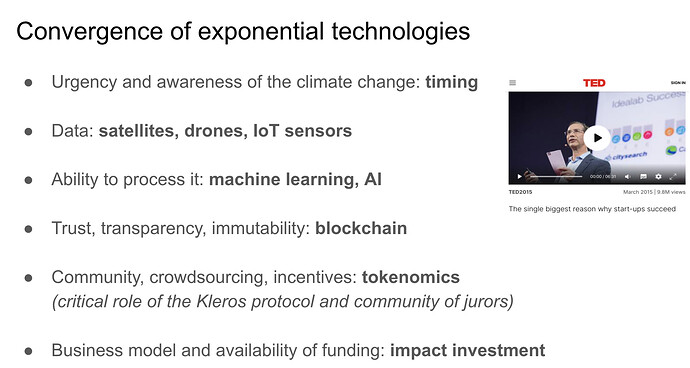

Go-to-market

Go-to-market strategy involves branching out to “normies”, not just crypto geeks. As of 2022 everyone is aware of climate change. I’m positioning this project as a way to evaluate existing environmental reports of Fortune 500.

Curate

The exact structure of curated registries of reports / evaluations / companies - I was thinking about creating a proxy (wrapper) contract that would put additional data on chain, rather than IPFS so it is easier to access by other contracts.

(technical debate, technical discussion, using existing battle-tested contracts but with a customization)

(next couple of days I will focus on technical feasability of it)

(comment from Clement about using curate was greatly insightful and I’m going to try this way)

DAO

DAO because currently it is just me, no team. I genuinely believe that there can be a sub-DAO for different areas of the project as well as independent contributions. At the same stepping up to the leadership and responsibility.

Token

Token that receives fees generated by the platform, something like xSUSHI. There will be also “negative value” and “positive value” tokens issued to the companies whose reports are evaluated.

For example:

- Exxon created 100k negative value (NV) from air pollution.

- Extinction Rebellion created 50k positive value (PV) from protecting forest.

I’m realistic - initially, noone from Exxon will buy PV to compensate for NV.

But… I see the way how PV can have value

Conscious and eco friendly businesses can offer a 10% discount. 90% regular cash payments and 10% accepting PV tokens. That’s waaaaaaay more realistic. Some businesses genuinely want to position themselves as green / conscious / woke.

If the system grows, if it gains traction, if there are users, community, media attention, and publicity - then those who received NV tokens may decide that for branding and reputational purposes they should acquire PV tokens to compensate.

So-called “loss and damage” is becoming a reality…

One of the question on the form - https://kleros.io/incubator/ - was total addressable market - I provided some estimates that 50x by 2050.

Bullish on climate change and adaptation.

Thinking big

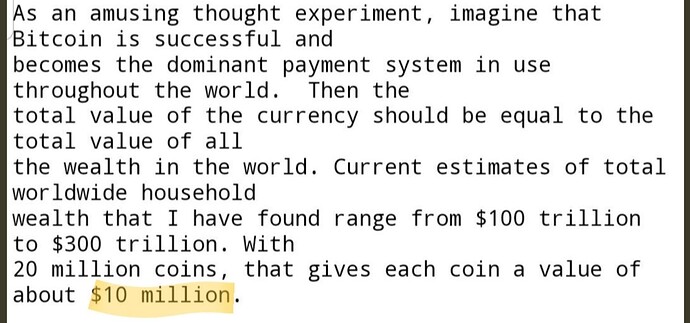

This was Hal Finney predicting price of BTC one week after the genesis block: x.com

I have a high conviction on BaseX. At the same time I’m aware of Confirmation bias - Wikipedia

I’m not easily offended, I’m proactively seeking constructive criticism.

![]()

![]()

![]()