Most likely the unsold tokens will returned to the seller, the Kleros Cooperative. See the relevant code: ERC20Seller/contracts/ERC20Seller.sol at 4186c5024ceba6907c852bce350256e966b954d0 · kleros/ERC20Seller · GitHub

Initial post is option  , Clement post is option

, Clement post is option

Option

No promo.

Linear increment all the way.

Large chunk at the baseline.

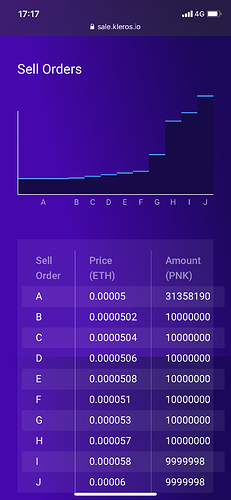

| Price |

Amount |

Comment |

0.000050 |

60m |

main no fomo |

0.000051 |

10m |

|

0.000052 |

10m |

|

0.000053 |

10m |

|

0.000054 |

10m |

|

0.000055 |

10m |

|

0.000056 |

10m |

|

0.000057 |

10m |

|

0.000058 |

10m |

|

0.000059 |

10m |

|

0.000060 |

10m |

|

Option

No promo.

Linear increment.

50% of the round to be sold between 0.00005 and 0.000055 in 5 tiers.

50% of the round to be sold between 0.000055 and 0.000075 in 5 tiers.

| Price |

Amount |

Comment |

0.000050 |

16m |

|

0.000051 |

16m |

increase by 0.000001 |

0.000052 |

16m |

|

0.000053 |

16m |

|

0.000054 |

16m |

|

0.000055 |

16m |

|

0.000060 |

16m |

increase by 0.000005 |

0.000065 |

16m |

|

0.000070 |

16m |

|

0.000075 |

16m |

|

Option

Increments are not linear, increments are exponential. 5 pricing tiers, each next pricing tier is multiplied by 1.02.

Followed by that, 5 more pricing multiplied by 1.05

| Price |

Amount |

Comment |

0.000050 |

16m |

|

0.000051 |

16m |

×1.02 |

0.00005202 |

16m |

|

0.0000530604 |

16m |

|

0.000054121608 |

16m |

|

0.0000568276884 |

16m |

×1.05 |

0.00005966907282 |

16m |

|

0.00006265252646 |

16m |

|

0.00006578515278 |

16m |

|

0.00006907441042 |

16m |

|

(actually, the exponential element is hardly noticeable, we could simply pick 2 significant digits)

Option

Time.

Previous proposals mention the amount of PNK sold, not the flow of time.

Just like Ethereum did back in 2014: https://cointelegraph.com/news/ethereum-raises-3700-btc-in-first-12-hours-of-ether-presale

The presale will run for 42 days, thus through September 2 [until 11:59 PM local time in Switzerland, GMT +1]. For the first 14 days, 1 BTC will buy you 2,000 ETH. Afterward, the price will go up linearly so that, on the final day, 1 BTC will buy you 1,337 ETH.

Would require a new contract, tests, review - unlikely.

Option

In option  the highest amount was

the highest amount was ×2 the initial.

In option  the highest amount was

the highest amount was ×1.2 the initial.

Maybe we can put some more incentives towards early purchase…

50% sold between 0.00005 and 0.00006 (×1.2 range)

40% sold between 0.00006 and 0.0001 (×2 range)

10% sold above (or not sold at all as too expensive, a substantial secondary market would be created)

Maybe we can design a hockey stick distribution?

Currently, trading PNK is rather uneventful. Chicken-egg liquidity issue. With 160m coming into circulation…

Which of the

options is your favorite?

options is your favorite?

We can pick and choose the favortite properties of each of the proposals…

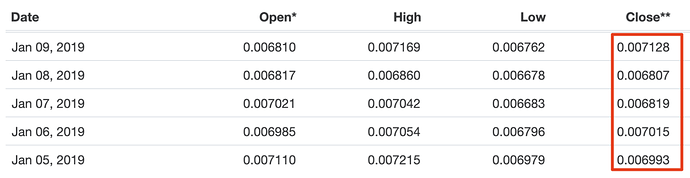

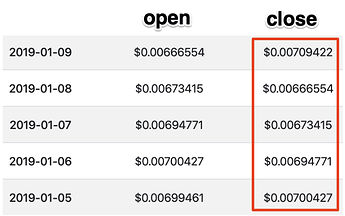

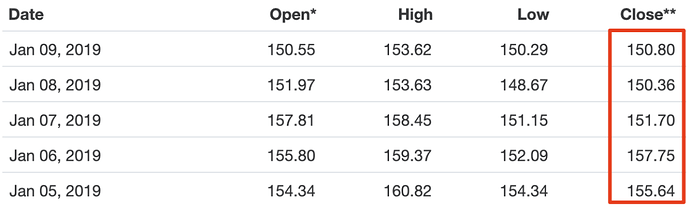

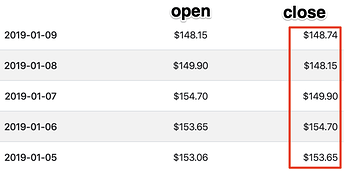

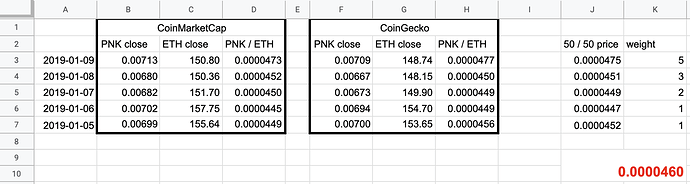

Also how exactly do we establish the baseline?

A few days before the sale ( how many ) a weighted moving average formula ( which ) should establish the exact baseline.