Date: 2023-12-22

Author: Kleros Cooperative

Context

Maintaining the economic security of the court is vital for Kleros protocol. “Kleros economic security” refers to the system’s resistance against attacks and manipulations by malicious actors. A higher staking percentage enhances resistance against attacks and reinforces trust in the protocol.

On Feb 3, 2021, the community voted KIP-37 in order to distribute rewards in PNK to all users that staked their tokens. The program was renewed by KIP-46 on Dec 22, 2021, and by KIP-58 on Dec 29, 2022.

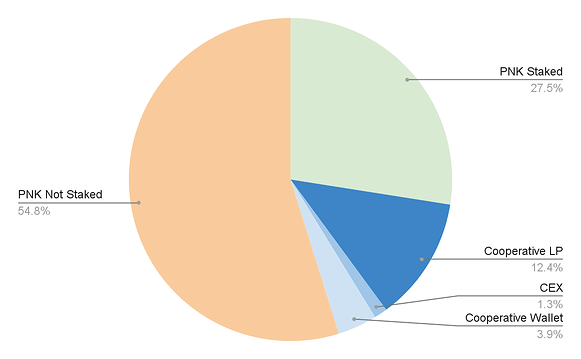

As of December 19, 2023, data from Klerosboard shows that approximately 213 million PNK are staked in Kleros courts across both Ethereum and Gnosis Chain. This represents 28% of the total PNK supply. Meanwhile, around 120 million PNK, or 15% of the supply, are held by the Cooperative (either committed for future compensation for team members or used for liquidity on platforms like Uniswap and Bitfinex).

Since the implementation of KIP-37, there has been more than 70% increase in PNK staked in Kleros (from 123M in March 2021 to 213M in Dec 2023).

The Juror Rewards Program was successful in increasing the proportion of staked PNK and bolstering the resistance of the protocol against 51% attacks.

Proposal

The goal of this proposal is to further increase the percentage of tokens staked in order to secure the protocol over the long term.

For this, it seeks to establish a long-term incentive program where users who stake their PNK tokens receive monthly rewards in PNK. The rewards to be distributed will depend on the duration and amount staked each month, calculated with the following formula.

The total reward for the next month (i+1) is given by:

R(i+1) = R(i) * (1 + t - s(i)), where:

s(i): Percentage of total PNK staked in monthi.R(i): Reward in month i (amount of PNK distributed in monthi).t: Target percentage of PNK.

The target will ramp up by 1% each month starting from 28% (current staking level) until it reaches 50%.

In Dec 2023, 28% of PNK are staked, so the target for Jan 2024 will be 29%, the target for Feb 2024 will be 30% and so on. Every month there will be a 1% increase up to a final target of 50% in Oct 2025. Since that moment, the target will remain at 50% every month.

The target of 50% was chosen because with 50% staked it is extremely hard for a malicious player to do a 51% attack with a market buy.

Below are examples for January 2024 and how February 2024 rewards could behave:

Reward(Jan24)=Reward(Dec23)*(1+Target(Jan24)-Staked PNK %(Dec23))

Reward(Jan24)=1 M*(1+29%-28%)=1.01 M PNK.

Example 1: Increase in Staked PNK % in January

If, hypothetically, the staking percentage increases to 32% in January, the reward for February 2024 would then be:

Reward(Feb24)=Reward(Jan24)*(1+Target(Feb24)-Staked PNK %(Jan24))

Reward(Feb24)=1.01 M*(1+30%-32%)=0.9898 M PNK

Example 2: Decrease in Staked PNK % January

If, hypothetically, the staking percentage decreases to 24% in January, the reward for February 2024 would then be:

Reward(Feb24)=Reward(Jan24)*(1+Target(Feb24)-Staked PNK %(Jan24))

Reward(Feb24)=1.01 M*(1+30%-24%)=1.0706 M PNK

With these two hypothetical examples we can clearly see:

- If the Staked PNK % increases over the target the rewards will decrease.

- If the Staked PNK % decreases below the target the rewards will increase.

Why this Formula?

The formula aims at continuing the increase of the percentage of staked PNK as well as to allow for a long term stability and predictability of the Juror Incentive Program.

Unlike the previous rewards model implemented by KIP-37, KIP-46 and KIP-58 which used a fixed total reward and that had to be renewed every year, this proposal adjusts the rewards efficiently, avoiding excess allocation when goals are met, and gives long term predictability to the program.

This formula also encourages decentralisation and behaviour alignment by rewarding users who contribute to securing the protocol through staking and adhere to Kleros’ long-term vision. The fact that the adjustment is done gradually gives market participants enough time to position themselves accordingly.

Allocation between Ethereum Mainnet and GnosisChain:

The proposed allocation is 90% on Ethereum Mainnet and 10% on Gnosis Chain. This allocation mirrors the previous year, focusing on having the maximum economic security on Ethereum Mainnet.

Specific Allocation for Kleros 2.0:

The Cooperative is currently working on Kleros 2.0 (more details here). At some point in the future, during a testing phase, Kleros 2.0 will be live in parallel to Kleros 1.0.

When Kleros 2.0 is deemed usable and secure enough, Kleros 1.0 will be deprecated and all the court activity will be moved to Kleros 2.0. This event will be called “The Kleros Merge” in analogy to the Ethereum Merge.

When Kleros 2.0 becomes live, before the Kleros Merge, 10% of the incentives distributed by this program will be directed to Kleros 2.0 jurors (leading to a 80% in Ethereum mainnet, 10% in Gnosis and 10% in Kleros 2.0). After the Kleros Merge, all the rewards will be distributed in Kleros 2.0.

Details

The tokens will be distributed using a Merkle Drop contract. The distribution will be done once a month and the computation of rewards may use snapshots.

Means

Initially, the reward distribution will be handled by the Kleros Cooperative. After Kleros 2.0 is launched, a proposal could be made to implement the distribution at the protocol level (and potentially auto-compound them).

At the beginning of each year, the Kleros DAO will mint for the Kleros Cooperative Safe (eth:0xE979438B331b28D3246f8444b74caB0f874b40e8) an amount of PNK corresponding to the current yearly distribution rate (rate of the last month of the year X12, so 12M PNK for the first year). At the end of each year:

- If there were more PNK distributed, the DAO will mint an amount corresponding to the difference between the initial minting and the amount distributed (ex: if 14M PNK were distributed in the first year, the DAO will mint 2M PNK) to reimburse the cooperative.

- If there were less PNK distributed, the Cooperative will reimburse the difference to the DAO (ex: if 10M PNK were distributed in the first year, the Cooperative will reimburse 2M PNK to the DAO).

Voting Options

- Yes, implement the program.

- No, rework proposal.