Introduction

In March 2018, we announced our first token sale with an ambitious roadmap ahead of us. Back then, we only had a prototype of the Kleros protocol set up on the Ethereum testnet.

Just a little more than a year after the initial token sale, we launched four different dapps, the Kleros Court, T2CR, Escrow and Oracle on mainnet and earned recognition from the entire blockchain ecosystem and far beyond.

Having completed the first roadmap to great effect, we are asking to conduct a new round. Cooperative Kleros has been committed from the beginning to create equal and transparent sale conditions for everyone.

We began as a self-funded entity, conducted our first sale using the IICO (Interactive Coin Offering) suggested by Vitalik Buterin and Jason Teustch as the best mechanism to fairly allow participation in every sphere of the blockchain community.

Now, having delivered on our promises, we are looking to conduct a second round which will in turn, be attached to the new roadmap of important and powerful developments we have ready to build.

Kleros has undoubtedly been one of the success stories of small, dedicated blockchain projects building mission-critical infrastructure towards the decentralizing of our digital future. Arbitration is a core element of any commercial or business architecture.

With this second round, we will be able to firmly cement Kleros’ place as the goto arbitration protocol both within Ethereum, and beyond.

Proposal

In this proposal, Coopérative Kleros requests the minting of 200 000 000 PNK to the multisig address 0x67a57535b11445506a9e340662CD0c9755E5b1b4.

Of those 200 000 000 PNK:

- 150 000 000 PNK will be sold in the second sale (see the sale document [1]).

- 50 000 000 PNK will be used for other purposes (see current use of PNK by the Cooperative [2]).

- Cooperative reserve (payment of contractors in PNK, exchange liquidity, development bounties, etc).

- Airdrops pool (allocations to users, contributors, people building on Kleros)

- Team allocation (incentivization of new team members on a vesting schedule).

Note that this proposal does not change the expected token allocation but mints tokens as a part of the token allocation plan.

Rationale

At the time of the proposal, the cooperative multisig holds 9 504 060 PNK (~69 332$). Minting new PNK is required for the second sale to proceed.

All proceeds of the sale will go to Coopérative Kleros whose goal is “to create, develop and promote a computerized and decentralized dispute resolution protocol” (see this blog post about the cooperative legal structure).

Coopérative Kleros also needs some PNK for its missions. Rewarding people who are building and participating in the Kleros ecosystem ensures that they can be jurors (thus get a good understanding of the system) and that they have aligned incentives in the success of Kleros.

Mechanics of the Sale

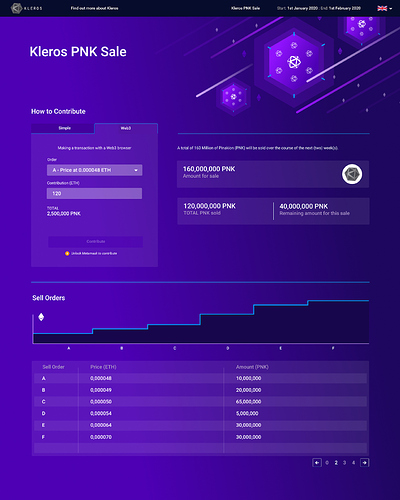

PNK is currently trading on a number of exchanges, a price already exists for the token. The mechanics of the sale are optimized for a situation where the token is already trading and will work as follows:

- The sale will open on the 11th of January 2020 16:00 UTC and run for an initial period of one month.

- Cooperative Kleros will sell 15% (150,000,000) PNK at an initial price of 0.00005 ETH per PNK. In the event of greater market moves before the sale date, this initial price may be subject to change.

- Coopérative Kleros will place sell orders of PNK as in a one sided exchange order book which is explained in the following section.

An Example Purchase

There are two options for participating in the sale, both of which are straightforward for the user creating as little friction as possible. Let’s take a brief look at the interface and how to interact.

As shown above, the interface is similar to that of a traditional exchange with a contribution section giving two options, a chart showing the stepped orders and a table with more details about the quantity of PNK and price in those steps.

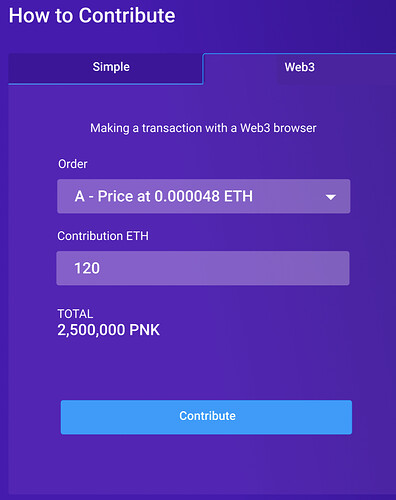

Web3

Using web3, the user has more control over the order step taken. This means the participant can allocate a set amount of ETH to any of the available orders (this ensures the buyer he won’t pay more than the order price). Once the TX has been made and confirmed, your PNK will be sent to your wallet immediately.

For example, you try to purchase 2,500,000 PNK for 120 ETH, but other buyers manage to buy 8,000,000 PNK before your order is mined (making it impossible for your order to be executed in full). You will get 2,000,000 PNK and 24 ETH will be reimbursed to you.

As one step is taken in full, the orders directly move to the next.

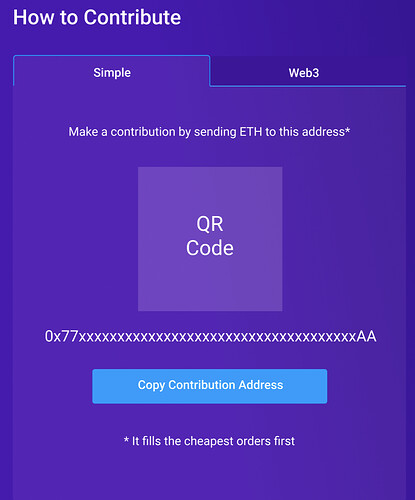

Simple

The simple function is just that. Send your contribution in ETH directly to the sale contract and get the lowest possible price in PNK.

That’s it!

Reference:

[1] Sale document

[2] PNK use document